Drawing on our entrepreneurial DNA, we anticipate tomorrow’s needs and design relevant financing solutions to accelerate positive transformations in society.

“The need to move to a sustainable growth model has never been more pressing. To ignore this is to lose the ability to operate in the future, regardless of the sector or industry.”

Mario Mitri, Chief Sustainability Officer, Tikehau Capital

What sets us apart

A differentiating asset: Sustainability by Design

Our rigorous approach involves the participation of all employees, allowing us to integrate sustainability criteria at every stage.

Sustainability experts are assigned to our investment teams to ensure proximity and skill development. Investments are evaluated based on both sustainability and economic criteria.

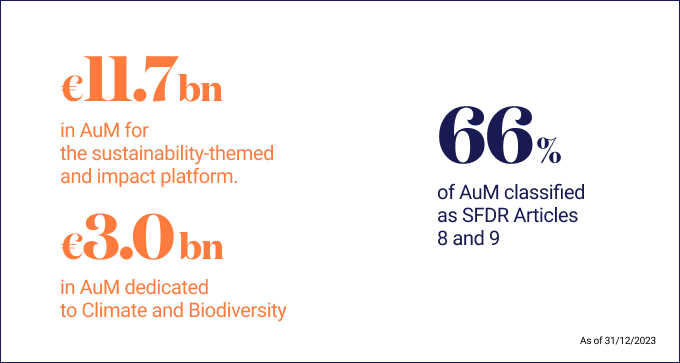

To go a step further, informed by scientific reports from the IPCC, the IEA and the work carried out on planetary boundaries, Tikehau Capital has set up a sustainability-themed and impact investing platform to help speed up the necessary transitions.

Video

Climate change: our approach

We believe that the climate emergency is an undeniable reality. It is our responsibility as asset managers to channel global savings as effectively as possible to accelerate the transformations needed to create sustainable value.

In this video, Mathieu Chabran, Co-founder and Pierre Abadie, Group Climate Director, present Tikehau Capital’s vision and approach to accelerate the transition to a more resilient and inclusive economy.

Our Sustainability by Design approach

Our responsible investment policy informs all our investment strategies and includes an exclusion list.

ESG integration is central to the Group’s strategy. Engagement initiatives are implemented as needed, with the aim of advancing portfolio companies’ sustainability journeys.

Proven ESG governance

Our ESG governance covers all levels of the Group, from the Supervisory Board to operational task forces.

In each of our asset classes, we adopt a disciplined Sustainability by Design approach.

Governance and Sustainable Development Committee

The Governance and Sustainable Development Committee of the Supervisory Board reviews the Group's sustainability strategy and ensures its progress.

Sustainable Development Strategic Steering Committee

The Sustainable Development Strategic Steering Committee sets the rules and structure for sustainability initiatives.

It defines excluded sectors and establishes a Group-wide watch list. It also develops collaborations and strategic partnerships on sustainability issues.

Directors with sustainability expertise and task forces

Each business line has a dedicated sustainability expert.

Coordinating with investment teams and supported by ESG analysts and interns, they ensure proximity, agility, skill development and the integration of sustainability criteria throughout the life of investments.

Impact Committee & Sustainable Bond Allocation Committee

For impact funds, an Impact Committee ensures that investment opportunities match the mission of each fund.

A Sustainable Bond Allocation Committee oversees the allocation of our sustainable bond proceeds.