Gaining the confidence of investors to accelerate our development.

Tikehau Capital’s financial partners recognise the Group’s long-term growth strategy. This confidence enables us to diversify our sources of financing and mitigate exposure to interest rate fluctuations. Furthermore, this supports the Group’s ESG commitments.

Presentation

September 2023 – Credit Investor Presentation

Presentation

October 2022 - Credit Update

Presentation

March 2021 - €500m 2029 Sustainable bond issue

Credit Rating

Fitch Ratings

In early 2019, Tikehau Capital was assigned its inaugural rating by financial ratings agency Fitch Ratings. This Investment Grade rating (BBB - stable outlook) confirms the strength of Tikehau Capital's financial profile.

On 15 May 2025, following its annual review, the credit rating agency Fitch Ratings confirmed its Investment Grade rating of "BBB-" with a stable outlook, highlighting the strength of Tikehau Capital's business model and financial structure in the current environment.

FITCH RATINGS RELEASES

Publication Date

File Type

S&P Global Ratings

On 21 March 2022, Tikehau Capital obtained a second financial rating from the financial rating agency S&P Global Ratings. With a stable outlook, this investment grade rating (BBB-) confirms the strength of Tikehau Capital's financial profile.

On 1 April 2025, the credit rating agency S&P Global Ratings reaffirmed its Investment Grade rating of "BBB-" with a stable outlook. The agency notably reiterated its confidence in the Group's ability to maintain financial ratios consistent with an Investment Grade profile while continuing to execute its strategic plan.

In its statement, S&P Global Ratings highlighted the company's ability to use its own balance sheet to develop new strategies and fund vintages, aligning its interests with those of investors and successfully accelerating the growth of third-party AuM. Moreover, S&P Global Ratings expressed its confidence in the Group ability to navigate the business through a volatile current environment.

File Name

Publication Date

File Type

Credit Lines

Syndicated Revolving Credit Facility

The syndicated revolving credit facility, amouting to €1.15 billion, was signed on December 10, 2025, for a term of 5 years. It includes two one-year extension options, thereby extending the Group’s financing horizon at least until 2030, and potentially until 2032.

Bonds & Private Placements

On 24 November 2017, the Group announced that it had placed a bond issue of €300 million, maturing in November 2023, with 3% coupon. Settlement took place on 27 November 2017.

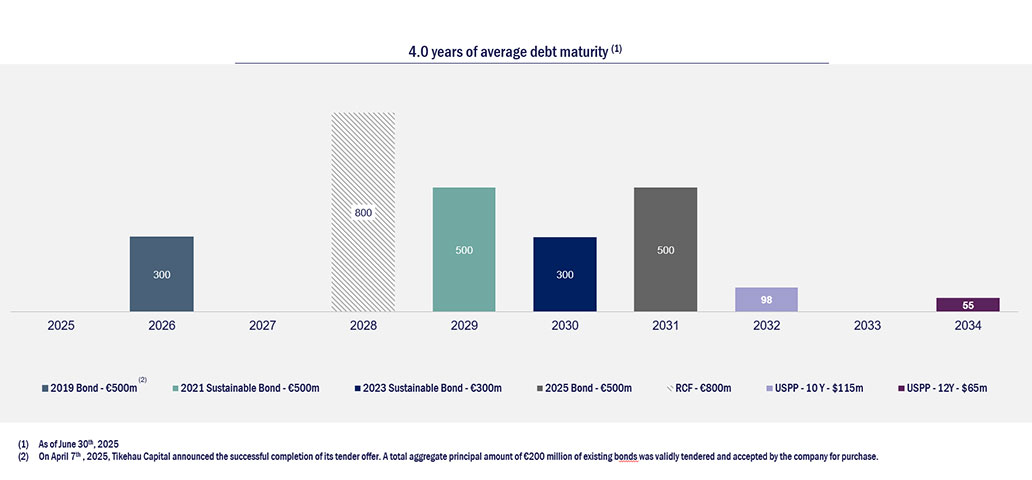

On 7 October 2019, the Group announced that it had placed a second bond issue of €500 million, maturing in October 2026, with 2.25%. Settlement took place on 14 October 2019.

On 24 March 2021, the Group announced that it had placed a third bond issue of €500 million, the first Sustainable bond issued by the Group, maturing in March 2029. Settlement took place on 31 March 2021.

This issue of senior unsecured sustainable bond is associated with a fixed annual coupon of 1.625%, the lowest ever achieved by the Group.

On 11 February 2022, The Group announced that it has successfully priced an inaugural US Private Placement (USPP) for a total amount of $180m structured in 2 tranches with maturities of 10 ($115m) and 12 years ($65m), the longest ever achieved by the Group. The use of proceeds will follow the same sustainable framework applying to the sustainable bond issued in March 2021. This transaction highlights US investors’ confidence in the Group’s credit quality and growth strategy over the long term and allows Tikehau Capital to diversify its sources of financing while emphasizing its commitment to sustainability. Pricing was completed on 11 February 2022 and closing occurred on 31 March 2022.

On 8 September 2023, the Group announced that it had successfully launched and priced a fourth sustainable bond issue in the amount of €300 million and maturing in March 2030. This Senior Unsecured sustainable bond issue is associated with a fixed annual coupon of 6.625%. Clearly oversubscribed, it has been placed with a diversified base of more than 60 investors and has been subscribed by more than 80% of non domestic investors.

On 28 March 2025, Tikehau Capital announced the launch of a tender offer for its existing bonds maturing in October 2026 and its intention to issue new bonds.

On 7 April 2025, Tikehau Capital announced the successful completion of its €200 million tender offer for its existing bonds maturing in October 2026, concurrently with the issuance of its fifth bond offering, amounting to €500 million and maturing in April 2031.

This Senior Unsecured bond issue carries a fixed annual coupon of 4.25%. Oversubscribed 2.8 times, the issuance was placed with a diversified base of over 130 investors.

Maturity Profile - Amortisation Plan

- 100% unsecured debt

- Diversified sources of funding (balanced between bonds and banking debt)

- Limited exposure to interest rate risk (with 92% of the total indebtedness with a fixed rate)

Bond Issues

Date

Currency

Amount (€m)

Annual Coupon

Maturity

Date

Currency

Amount (€m)

Annual Coupon

Maturity

Date

Currency

Amount (€m)

Annual Coupon

Maturity

Date

Currency

Amount (€m)

Annual Coupon

Maturity

Date

Currency

Amount (€m)

Annual Coupon

Maturity

Date

Currency

Amount (€m)

Annual Coupon

Maturity

ESG