Investing differently

In response to scientific reports from the Intergovernmental Panel on Climate Change and the International Energy Agency, as well as their work on planetary boundaries, Tikehau Capital has established a sustainability-themed and impact investing platform.

Sustainability-themed and impact investing

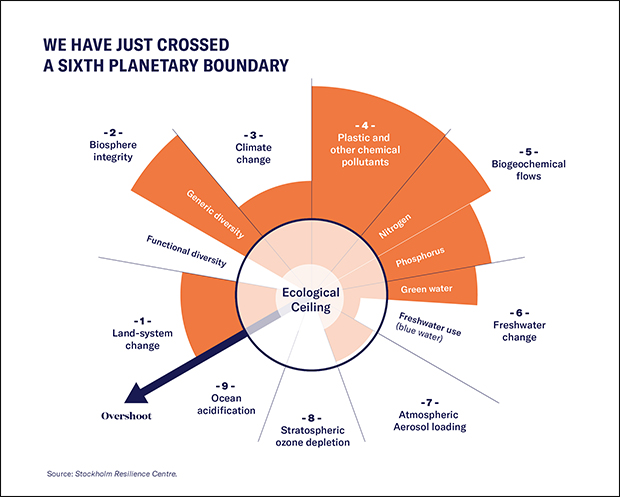

Focus on planetary boundaries

Globalisation has favoured efficiency over resilience, the global over the local, and economic growth over the living. Since 2009, the team at the Stockholm Resilience Centre (Sweden) has been working on the concept of planetary boundaries by modelling the nine main processes that regulate the planet and the thresholds that must not be exceeded in order to maintain the state of the planet’s ecosystem.

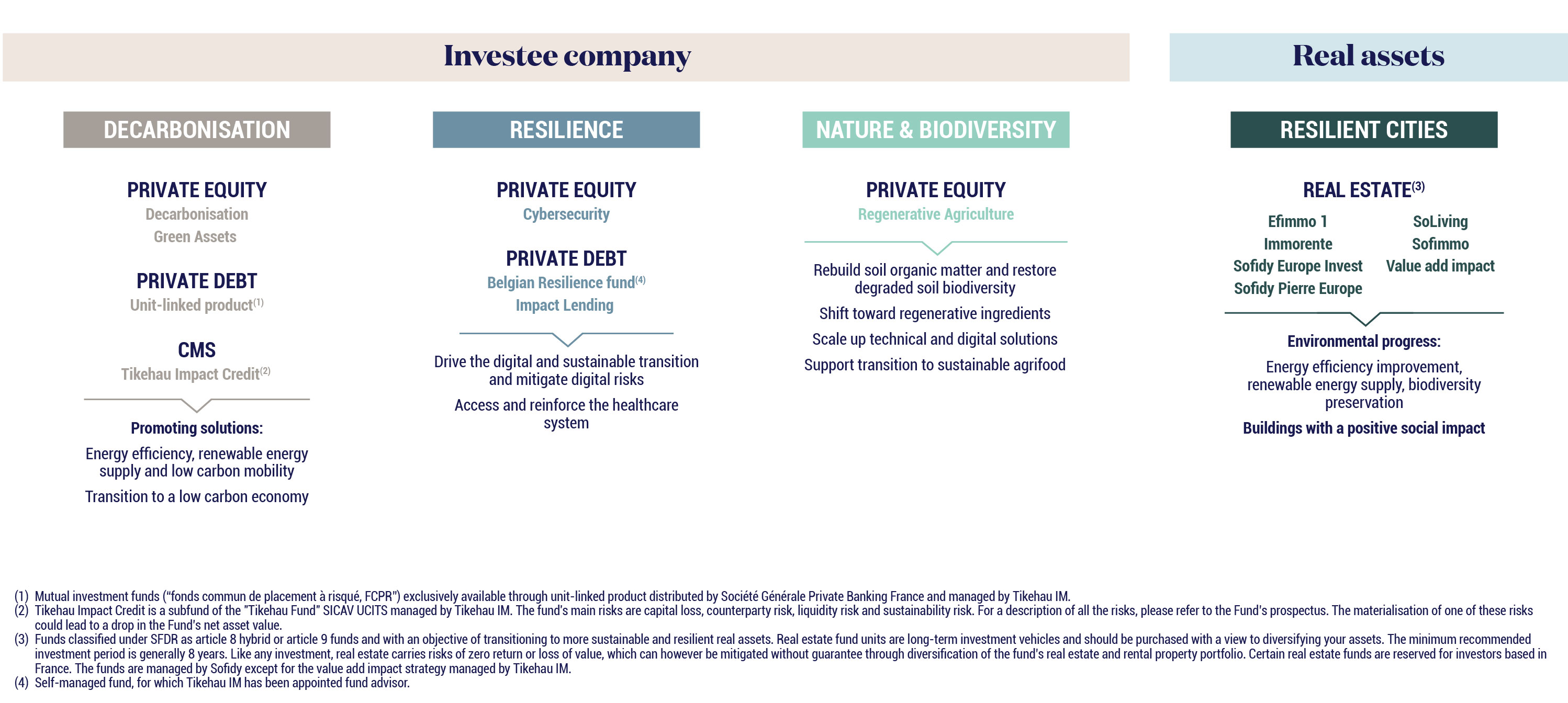

Climate change affects all regions of the world, and its impacts are intensifying. To help address these global challenges, Tikehau Capital has established a sustainability-themed and impact investing platform focusing on four priority themes: decarbonisation, nature & biodiversity, cybersecurity and resilience.

OUR ACTION

Four themes

To help accelerate the necessary transitions, Tikehau Capital has established a sustainability-themed and impact investing platform.

Rigorous criteria

Our impact framework

Tikehau Capital distinguishes between “impact investing” and “sustainable investment” according to the SFDR’s definitions. The Group’s impact approach is based on international reference frameworks (Global Impact Investing Network – GIIN, IRIS+, SDGs, Impact Management Project, UN PRI, etc.).

Our approach to impact investing is based on five pillars:

Intentionality

An impact fund’s investments must contribute to its mission, or “theory of change”.

Impact measurement

Impact measurement goes beyond simply monitoring financial performance to complete the investor’s visibility of a company.

Additionality

In an impact fund, teams work to help companies and assets accelerate their transformation or positive impact.

Alignment of interests

We are committed to investing in all of our impact funds. In early 2022, the Group’s management strengthened our approach by introducing a standard whereby a portion of the carried interest allocated to the asset manager of new impact funds is indexed to ESG criteria.

External verification

External verification of the implementation of non-financial commitments for impact funds.